Is private equity as an asset class just stocks on steroids?

The new PowerShares International Listed Private Equity ETF begins trading under the symbol PFP. Like the previous Powershares ETF PSP, the new ETF is based on an index by Red Rocks Capital Partners out of Denver, CO. Here is the PowerShares Fact Sheet for PFP. Here is a primer on Private Equity from the Private Equity Council.

All of the information for the two funds can be found at www.listedprivateequity.com. The website makes me beg the question, is there going to be an international listed hedge fund ETF in the works? Keep an eye on www.listedhedgefunds.com. (Why not www.listedhedgefund.com you ask? PowerShares if you are reading I would be happy to sell the domain to you. . .)

On principal I like the concept of the foreign fund better. Its holdings are actual listed private equity funds versus private equity fund management companies. Since I am an empirical skeptic, I reserve my judgment until seeing the data. (I am also not sure why the performance numbers are similar but slightly different in the Powershares PDF’s and the ListedPrivateEquity performance tables. I used the latter for all numbers below.)

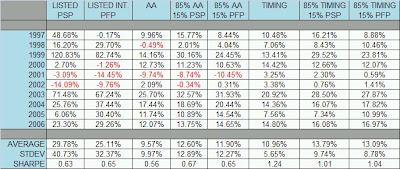

Both indexes (I am just going to refer to the ETF symbols from now on) have returned over 20% per annum since 1997. Both are very volatile – around 30-40%. Drawdowns would have been in-line with stocks – 35 to 45% (this is surprising low to me). I was actually expecting better numbers out of the foreign listed fund, but that is not the case. They are both very similar on a risk adjusted basis. These are hypothetical returns, but that is the best we have.

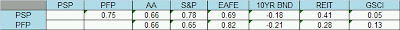

Here is a correlation table (with the recent post caveat that correlations are unstable!) for monthly returns vs. some standard asset classes (some of these charts you may have to click on to zoom in on the #s):

The two funds are pretty highly correlated at .75. (US Stocks and foreign stocks have similar correlation numbers over the same period ~ .79.) PSP is more correlated to US Stocks, and PFP is more correlated to foreign stocks, which makes sense.

AA refers to an endowment style asset allocation (20% each in US Stocks, Foreign Stocks, Bonds, REITs, and Commodities), and Timing refers to a simple timing model on the AA portfolio. Adding private equity to a buy and hold allocation (AA) could add 200-300 bps with a bump in volatility and risk-adjusted returns.

[A good rule of thumb I use when eyeballing a passive asset allocation portfolio is this: The CAGR and volatility should be around a 1:1 ratio (CAGR higher is obviously better). The drawdown will likely be 2X the CAGR. ]

It depends on how much Red Rocks/PowerShares optimized the index construction for constituent holdings, but for the most part the ETFs look pretty good to me. It would make the most sense to me to substitute some of the US equity exposure with PSP and some of the foreign exposure with PFP. Conversely, those looking for juiced returns that don’t mind the extra volatility could just add additional private equity exposure instead of substituting. I don’t see any reason why the timing model would not work on private equity. The most important question now is – “Is this the right time to be allocating to private equity? Or are we too late in the cycle?”.

Now, PowerShares, how about that hedge fund ETF ?