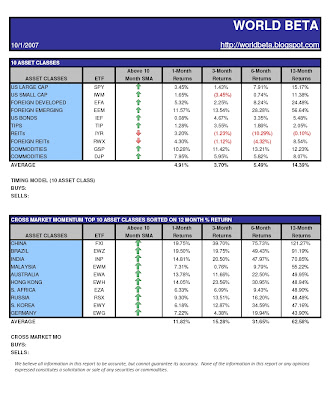

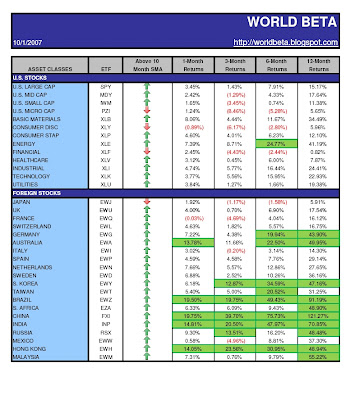

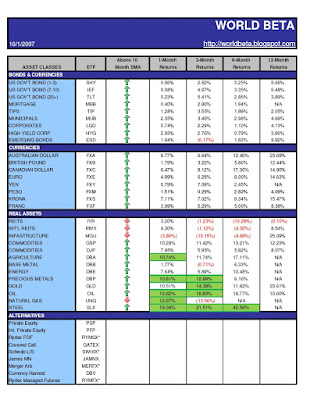

I spend a lot of time thinking about momentum. One of the problems with the cross-market momentum approach is that it can leave you undiversified and exposed to large drawdowns due to concentration risk. ie if someone followed the approach with the asset classes below, selecting the top 10 based on 12-month returns, he would have returned about 10% for the month. However, most all of your positions would be in emerging markets.

Has anyone seen any research on cross-market momentum that selects the top X-positions from each asset class? For example, take the top two asset classes from each asset class category (top 2 from US Stocks, top 2 from Foreign Stocks, top 2 from Bonds, etc, etc)? I have not seen much research in this space.