With fiscal year returns of 28%, it looks like Yale has the title of top endowment manager locked up.

With fiscal year returns of 28%, it looks like Yale has the title of top endowment manager locked up.

The Yale endowment recently reported their investment returns, and the spectacular 28% tops the impressive Harvard returns of 23%. They handily beat the S&P500 (20%) and foreign stocks (27%), and swells their AUM to $22.5 billion. It looks like PIMCO hired the wrong guy!

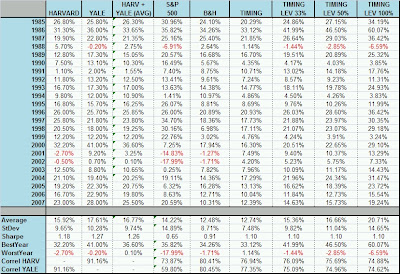

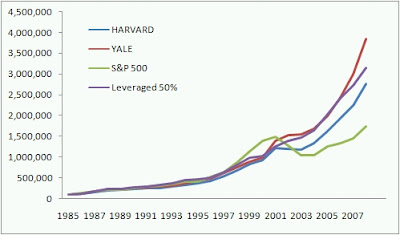

I updated the table and chart from the earlier EndowWOWment post below. Even with the amazing returns of the past 4 years, a simple timing model (leveraged 50%) does a good job of approximating the endowment returns (about .75 correlation). A 2X levered allocation would beat both of the endowments with near 20% annual returns, and a worst year of -7%. (I used commercial paper to estimate the margin rates. Discount brokers such as Interactive Brokers have margin rates in line with CP.)

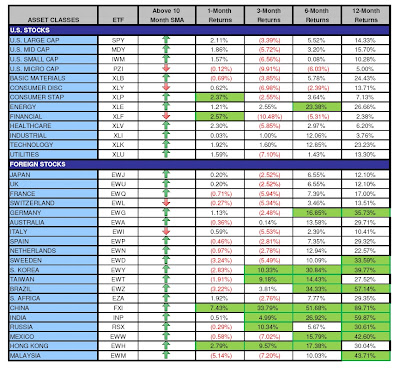

An investor could replicate the timing model with these sample ETFs:

US STOCKS: SPY, VTI, MDY, IWM

FOREIGN STOCKS: EFA, EEM

US BONDS: IEF, AGG, TIP, HYG

REITS: IYR, RWX

COMMODITIES: GSP, DBC,

I get lots of emails asking about updating moving averages for timing models. Here is a table I use for internal use. If there is enough interest (leave a comment), I can post this PDF monthly. (Green cells are top 10 performance for that time period. I extrapolated some performance for some ETFs without 12 months of history.)