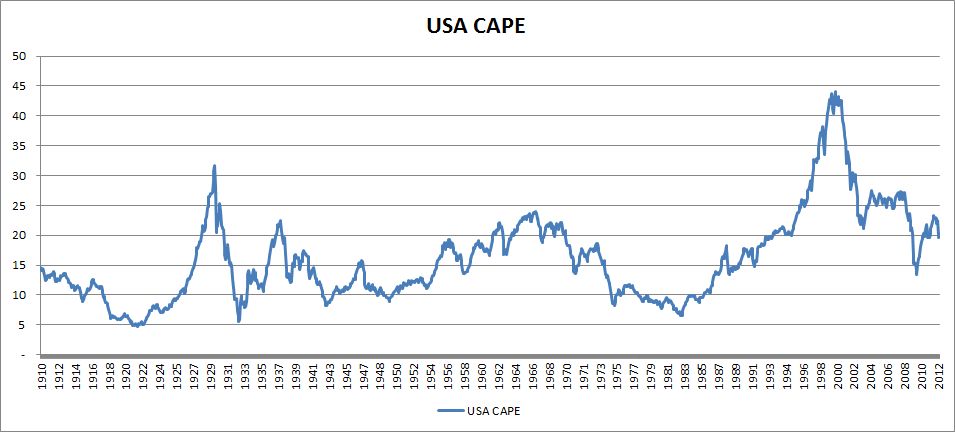

Most stock market valuation models are not that predictive in the short term. However, value tends to work great on longer term timeframes. We rebuilt Hussman’s valuation models (both the PE and dividend ones) with the Shiller data, and right now at future P/Es of 15 the US stock market should do about 5% a year nominal (so, net of inflation maybe 2-3% per year) over the next decade. P/E contraction to 10 means -3% losses per annum, and a future PE of 20 implies around 8%. (We also rebuilt the Arnott models on CAPE and inflation here.)

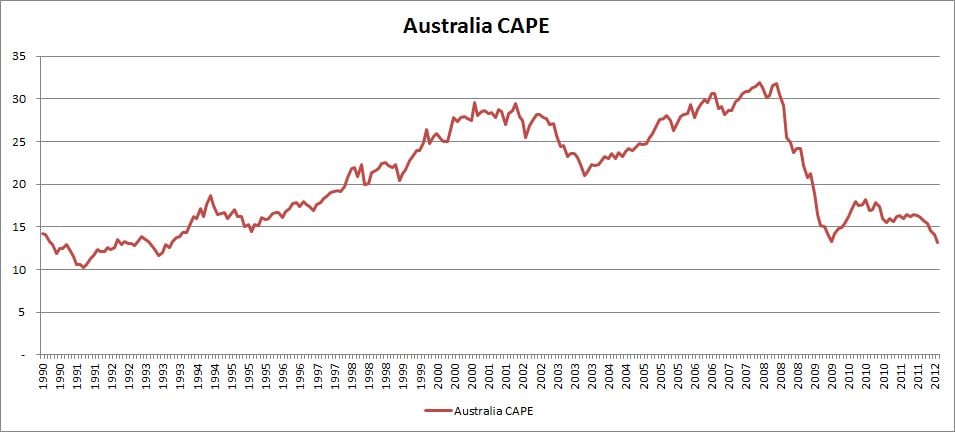

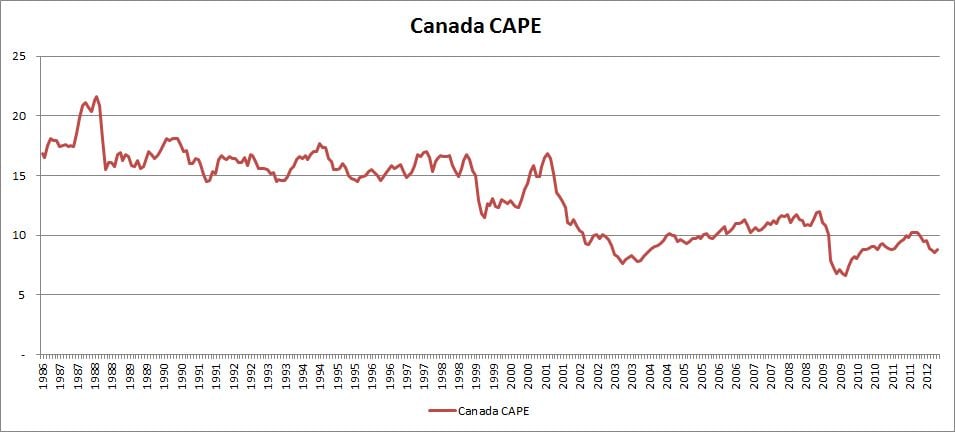

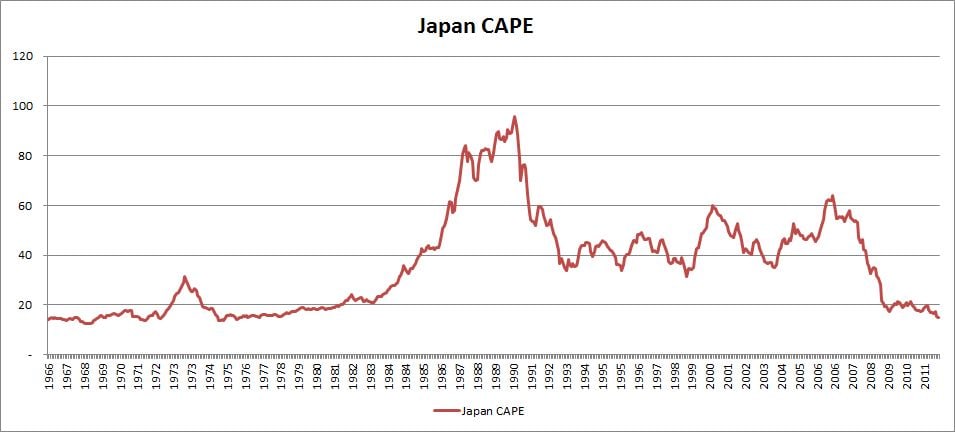

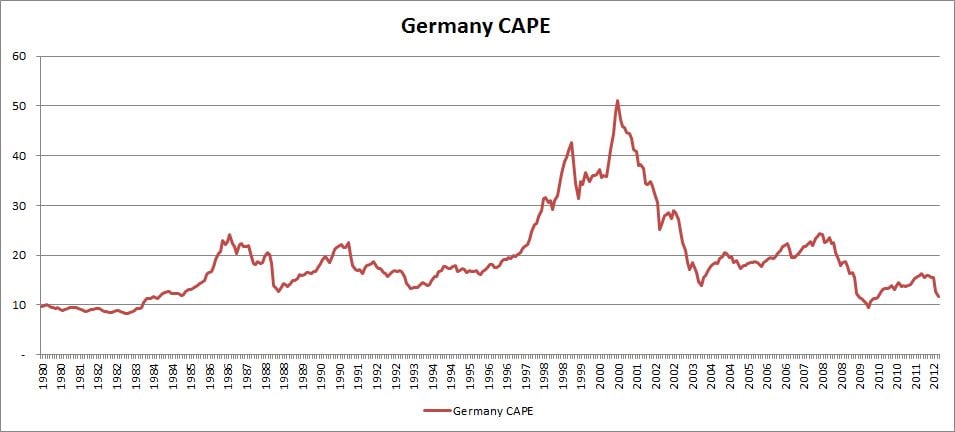

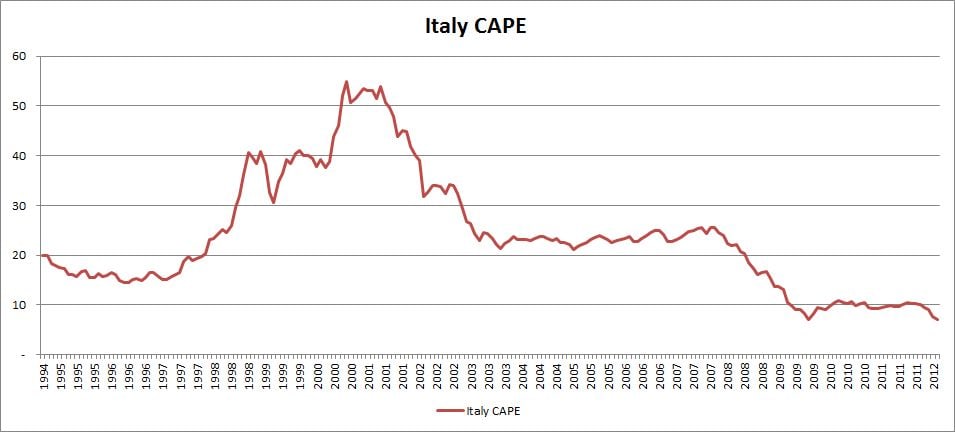

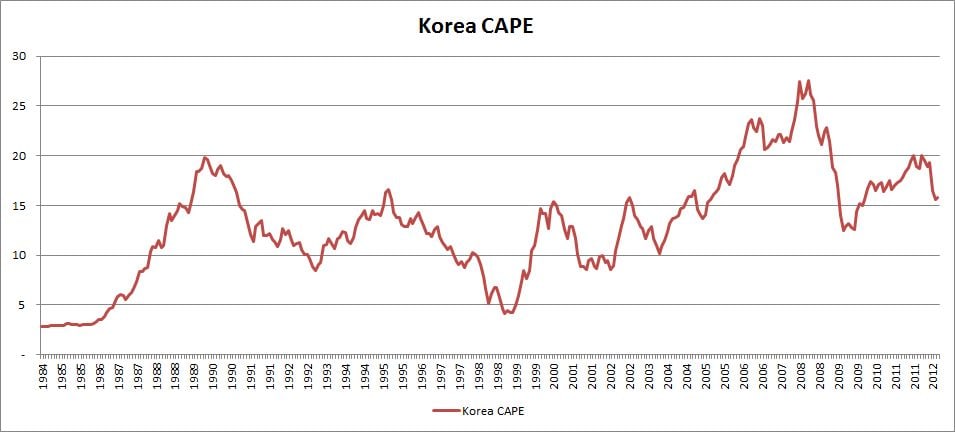

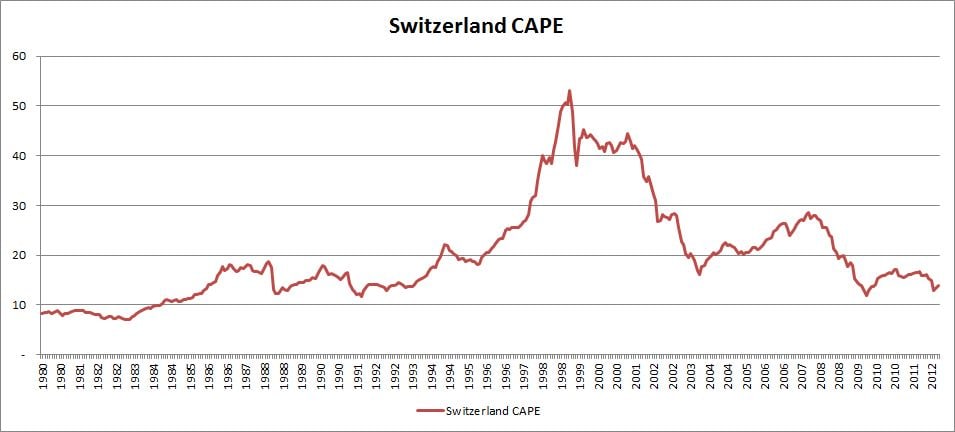

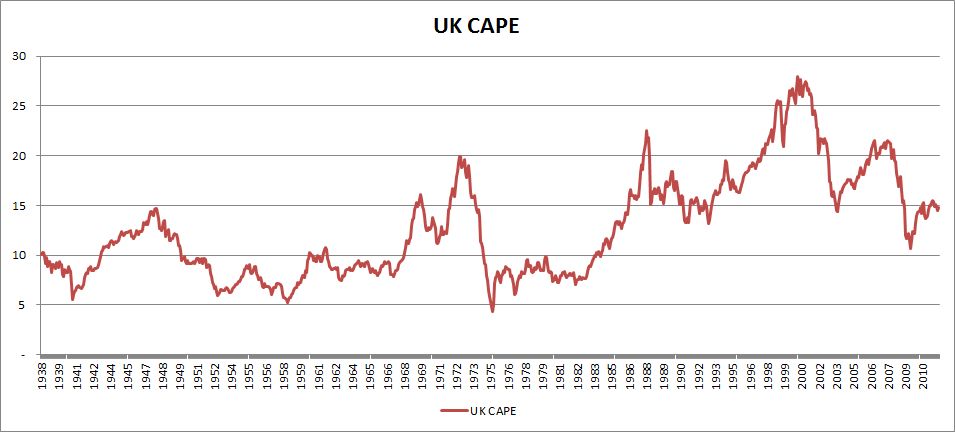

We couldn’t find much in the way of Shiller CAPE’s for foreign markets, so we have built a lot of these in house. There is a lot of evidence showing sorting countries on value produces outperformance over time (section in the Tweedy Browne paper and an old post here: sorting countries by dividend yield).

Source: Global Financial Data