There are very few asset classes that are truly non-correlated to a traditional portfolio. (There are active strategies but that is a bit different.)

I think Lending Club is an interesting example for an asset class that is hard to commoditized as a public fund – consumer credit. I allocated $50 worth of notes a few years ago, and then promptly forgot about it. Low and behold I am sitting on a fat 12.5% gain, ha. Anyways, they started a RIA with private funds and separate accounts. I think a public fund would be difficult with the exception of a closed end fund. Anything else that would be similar?

—-

Interview with Kahneman, HT RR:

—-

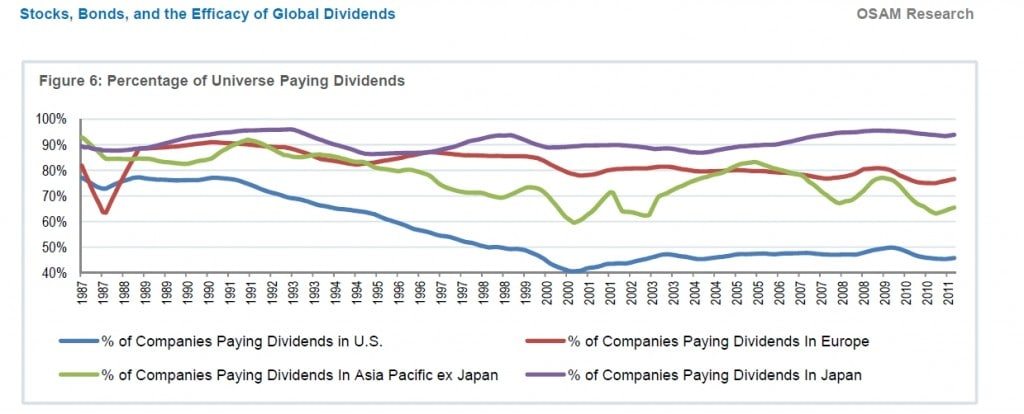

Great piece “Stocks, Bonds, and the Efficacy of Global Dividends” (PDF and PPT) from OSAM. Highly recommend both…having a hard time pasting the graphics but worth a read.