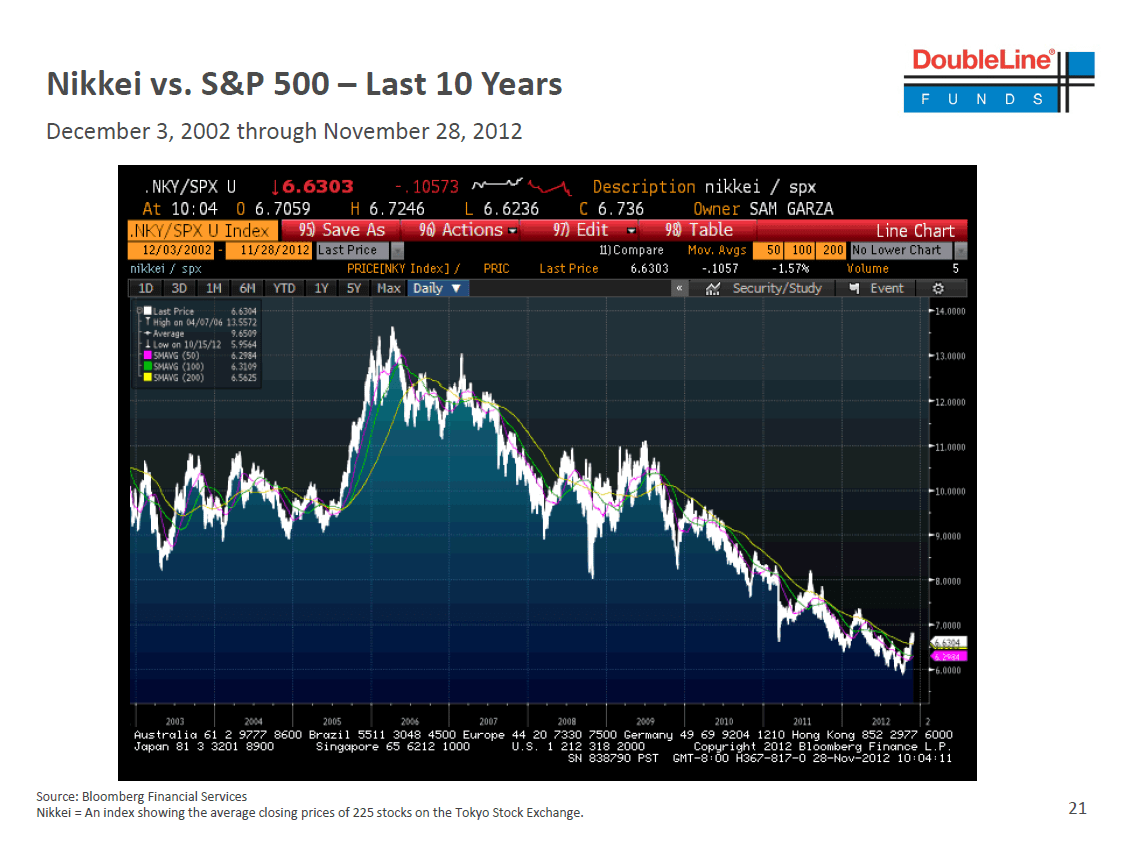

In the Gundlach call today (PPT here), he referenced the returns to Japan and US equities over the past 10 years. Japan has a total return of -9.15% while the US has had a return of 27.59% (both real returns after inflation).

Here is the slide:

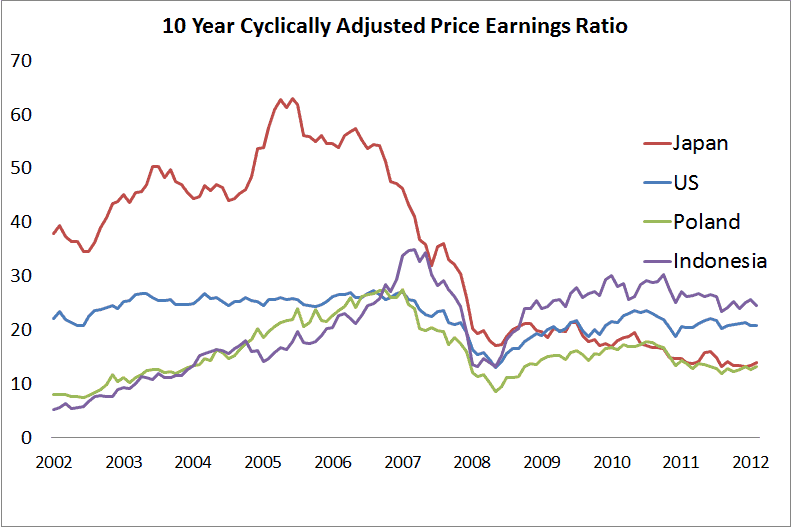

Why has Japan performed so poorly? Simple – it was still working off the valuation hangover from 1989. 10 years ago the CAPE for Japan was 38 while the US was a more reasonable 22 (although both are over the long term mid range for countries of around 15-20, US median since 1890 is 17 or so).

What if instead of investing in the relatively overvalued US and Japan, an investor invested in the two cheapest countries? From our database this was Indonesia and Poland, who traded at CAPE ratios of 5.3 and 8 respectively.

How did all four countries perform?

10 Year total real return:

Japan: -9%

US: 28%

Poland: 42%

Indonesia: 489%

So where are you allocating your dollars today, something expensive, or something cheap? More background in our paper here: Global Value: Building Trading Models with the 10 Year CAPE