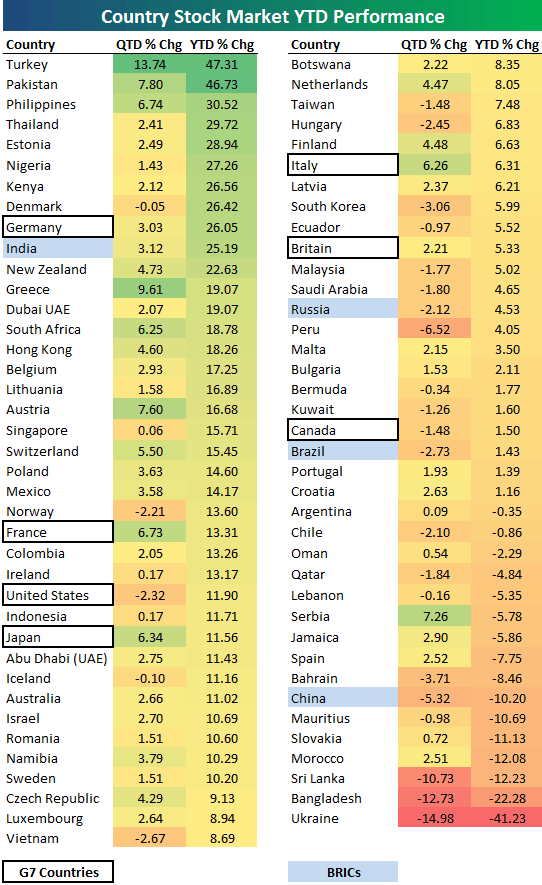

If you read The Ivy Portfolio you would have seen a few sections on quant reversion strategies. One strategy is to look for asset classes that were down both two and three years ago (1,2, and 3 years ago is even better). The median return from our study after down years two and three years ago was 19% (vs ~12.66% for all observations). The median return after three down years in a row was 25.78%. A bunch of countries are down 2/3 years ago at the end of 2012, but only a few may be down three years in a row (potentially). We only track about 40 countries while our friends at Bespoke do closer to 70: