I penned a short market outlook last year , and this year’s outlook is basically the same. It was correct on a few points (small cap underperformance, dividend stock underperformance), and incorrect on a few points (US stocks charged higher, foreign stocks lagged). We now have an interesting period where US stock valuations (CAPE of 27) relative to foreign stock valuations (around 15) will close at the highest level over the past 35 years. Four out of five of the biggest relative overvaluations resulted in big foreign outperformance the following year. The only exception? 2014

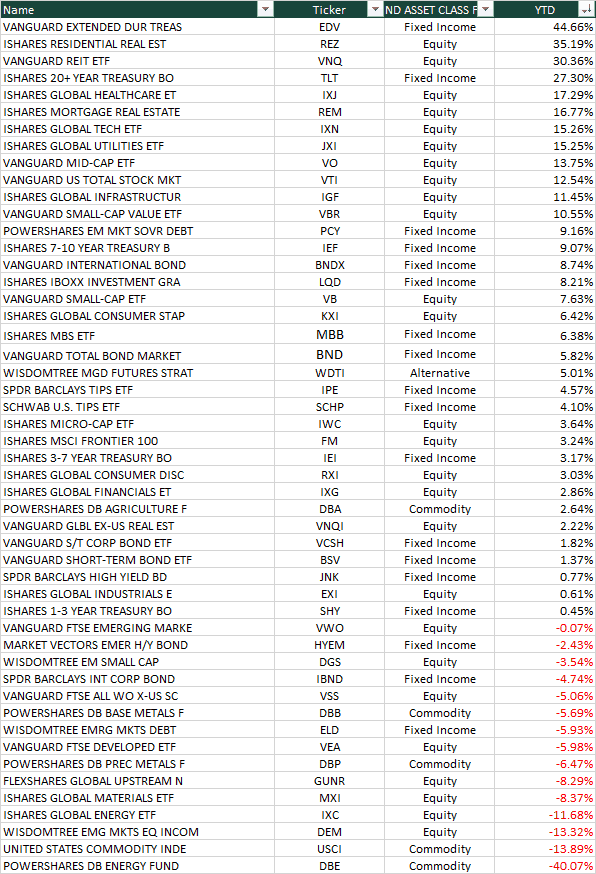

Below you can see just how fantastic 2014 was (real estate, bonds, US stocks) or terrible (commodities, foreign stocks).

Asset Class Returns

The moderate portfolio from our old while paper is ending 2014 on a fairly conservative note – only 40% invested in US stocks and real estate, and 60% in cash and bonds (out of commodities & foreign stocks). As you recall from my old articles, the best environment for US stocks is cheap and in an uptrend. The worst? Expensive and in a downtrend. We are currently in the middle (expensive, uptrend). When the trend changes, watch out!

However, most of the positive momentum in the world is still in US based assets – stocks, real estate, and bonds. Most of the value is found in foreign equity markets (and arguably commodities, but with less traditional valuation methods). My favorite intersection is when value and momentum intersect. If and when the trend changes I think you could see truly explosive returns for foreign equity markets. But as we all know, and oil is a timely reminder of this now, trends can last a loooonnng time. And if US assets are the final shoe to drop….well then all equities around the world will get cheaper.

Summary:

1. US stocks are expensive, but not quite in a bubble. Future returns should be around 3% (nominal) per year. US bonds likewise should return around 2.2% per year. Both should return around 0-1% real. US stocks can continue their strong returns and get more expensive, but if and when the trend changes, it would be wise to be more conservative.

2. Foreign stocks are priced for higher returns, but currently in a downtrend with terrible momentum.

3. Here is my allocation for 2015. As a trendfollower, I like the idea of having half of my portfolio being tactical and able to move to cash or hedges if markets trend down. As a value investor, I also want exposure to assets that may be cheap over long horizons. Main changes since last year have been rolling the old private fund assets into GMOM, allocating to new funds (new private fund strategy, new launches GMOM and GAA), and rebalancing to buy more beaten down holdings (GVAL).

Broad Groupings

Tactical or Market Neutral Strategies 44%

Long Only Strategies 56%

Within those categories:

GVAL 25%

GMOM 23%

Private Fund 21% (Cambria Special Situations – a leveraged, tactical fund investing in US stocks, is 200% gross long and can be 0 to 100% net long)

GAA 18%

FYLD 12%

SYLD 1%

I will update again in 2016!