In our last piece, we examined just how long US stocks can go underperforming US bonds. The answer was, a lot longer than most could handle.

But what about a more comparable asset – stocks outside the US?

US stocks have trounced foreign stocks for as long as anyone can recall. Though as podcast alum Edward McQuarrie has pointed out, that might just be a case of “right hand chart bias“. That’s when an asset has performed well recently it looks like it has ALWAYS outperformed, even though there could be many periods of underperformance too.

Here’s his example of US stocks vs. bonds:

What’s any of this have to do with US vs. foreign stocks? Well, Since the GFC in 2009, it’s felt like U.S. stocks could do no wrong, and you’ve made over 900%. For foreign stocks a measly 300%.

America has been the belle of the global equity ball. But history has a funny way of humbling those who extrapolate recent trends forever.

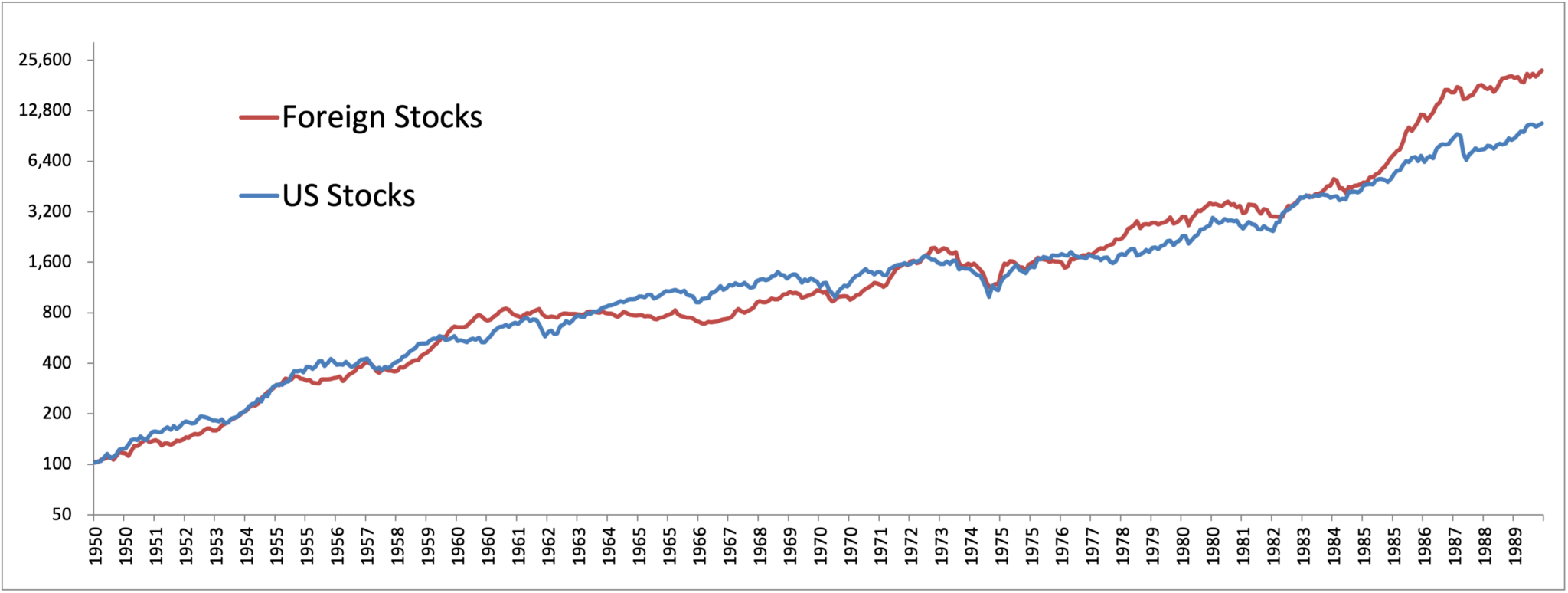

Here’s the kicker: U.S. stocks can—and have—underperformed foreign stocks for decades.

Let’s rewind the tape. Many can recall the recent 2000 to 2010 decade, dubbed the “lost decade” for U.S. stocks, where the S&P 500 actually lost money. Meanwhile, foreign developed markets (think Europe, Japan, etc.) and especially emerging markets (hello, BRICs!) posted solid gains. It was the classic case of trees not growing to the sky.

The attached chart hammers this home. If you were sitting in the U.S.-only camp for the entirety of certain periods, you would’ve trailed globally diversified portfolios by a mile. And it’s not just cherry-picking—we’re talking decades-long stretches.

That was four decades from the 1950s through the 1980s. If you go back to the 1800s, foreign stocks outperformed the United States for 60 years at one point.

What if the outperformance lasted year after year? Try to imagine five or six years in a row?! Could never happen, right? It literally happened about 20 years ago, lol, and also in the 1980s. Investors often tend to extrapolate from the recent past, with US stocks outperforming foreign markets in 12 of the last 15 years. With significant foreign outperformance this year, is the Bear Market in Diversification ending?

The key lesson? Diversification isn’t just a cute slogan—it’s a survival tactic.

Our home country bias blinds us.If you’re loading up on U.S. stocks after a 15-year run because it “feels right,” that’s your lizard brain talking. History says beware. Valuations matter. And when U.S. CAPE ratios are touching the stratosphere while foreign markets are lounging in the basement, future returns tend to follow the inverse path.

The solution? Own the haystack, not just the American needle. A global value tilt, rebalanced periodically, gives you a shot at participating when leadership changes—as it always does.

If your portfolio is a 100% U.S. allocation, it might be time to zoom out. There’s a whole world out there, literally.

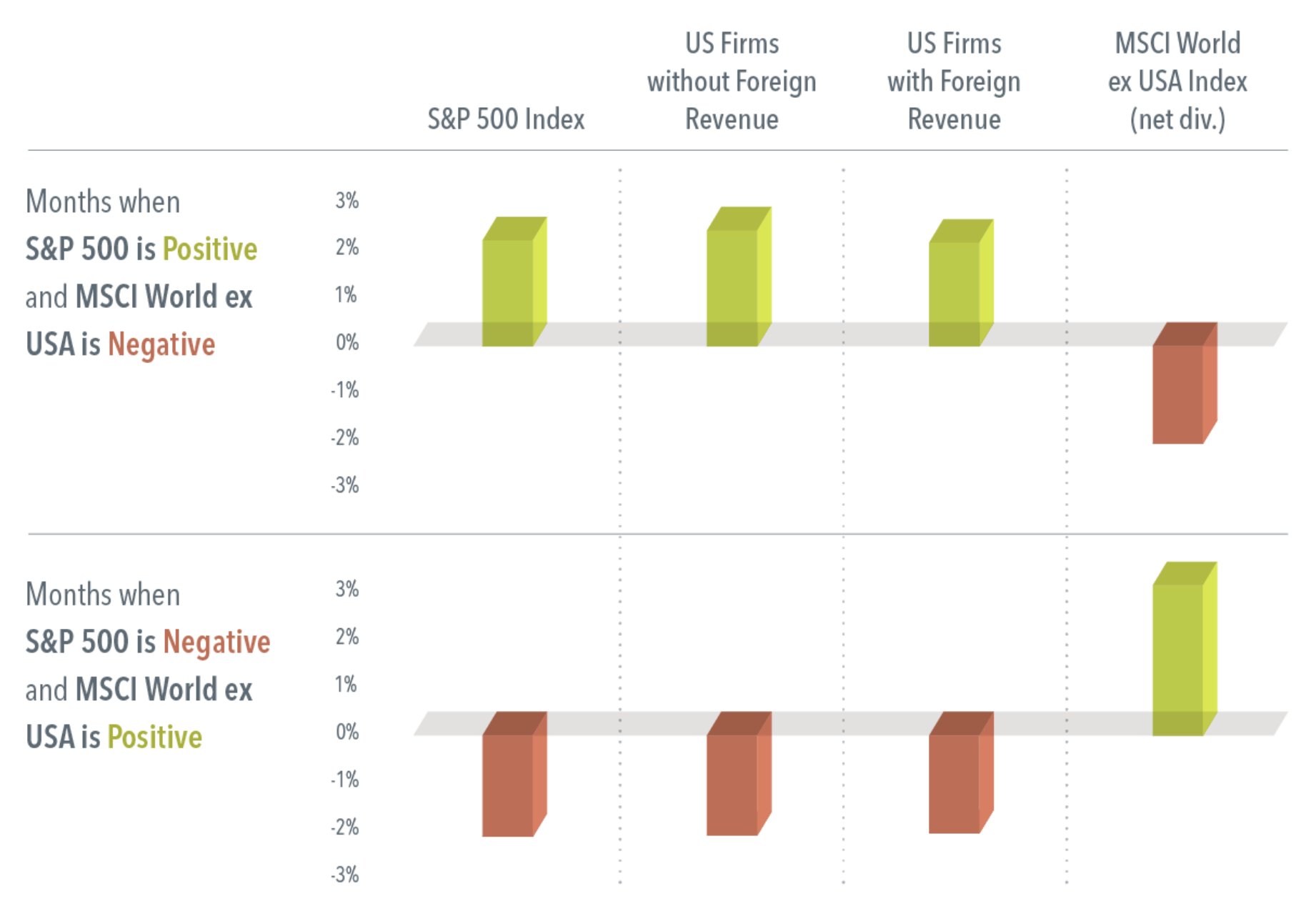

PS Many US investors put all their bets on US stocks. When we bring up the dangers of this “home country bias” then often respond that they have foreign exposure due to US companies having revenue from foreign countries. For those who think they can get their foreign exposure through US stocks with foreign revenue, turns out it doesn’t diversify the way you think it might. Partially, some of this will have to do with the movement of the US dollar vs. foreign currencies.

Here is a nice chart from Dimensional: