I have been contemplating writing a book or white paper on asset allocation strategies. But like many pieces I have started to write this summer, I have simply ended up condensing an entire 200 page book into one blog post. Maybe it is a case of summer-itis, but I seem to be following the old Thoreau quote – simplify, simplify, simplify.

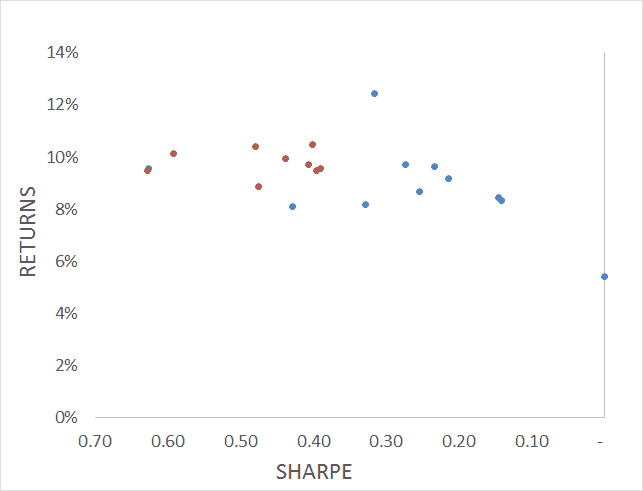

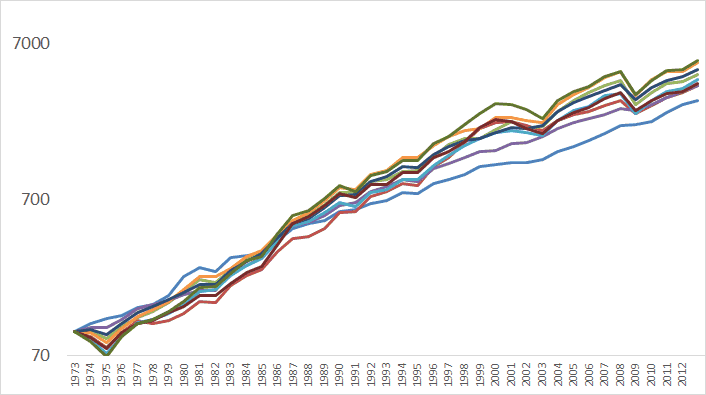

Below are a handful of the most popular asset allocation strategies from lots of different gurus. I did my best to recreate their allocations from public asset classes back to the 1970s. So which asset allocation strategy performed best?

Scroll to the bottom to find out!

60/40

60% US Stocks

40% US 10 Govt Bonds

Swensen Portfolio (Source: Unconventional Success, 2005)

30% US Stocks

20% REITs

20% Foreign Stocks

15% US Govt Short Term

15% TIPS

El-Erian Portfolio (Source: When Markets Collide, 2008)

15% US Stocks

15% Foreign Developed Stocks

12% Foreign Emerging Stocks

7% Private Equity

5% US Bonds

9% International Bonds

6% Real Estate

7% Commodities

5% TIPS

5% Infastructure

8% Special Situations

Arnott Portfolio (Source: Liquid Alternatives: More Than Hedge Funds, 2008)

10% US Stocks

10% Foreign Stocks

10% Emerging Market Bonds

10% TIPS

10% High Yield Bonds

10% US Govt Long Bonds

10% Unhedged Foreign Bonds

10% US Investment Grade Corporates

10% Commodities

10% REITs

Permanent Portfolio (Source: Fail-Safe Investing, 1981 )

25% US Stocks

25% Cash (T-Bills)

25% US Long Bonds

25% Gold

Andrew Tobias Portfolio (Similar to Bill Shultheis & Scott Burns’s 3 Fund portfolios)

33% US Stocks

33% Foreign Stocks

33% US Bonds

William Bernstein Portfolio (Source:The Intelligent Asset Allocator, 2000 )

25% US Stocks

25% Small Cap Stocks

25% International Stocks

25% Bonds

Ivy Portfolio (Source: Ivy Portfolio, 2009)

20% US Stocks

20% Foreign Stocks

20% US 10Yr Gov Bonds

20% Commodities

20% Real Estate

Risk Parity Portfolio (Unlevered, Faber PPT)

7.5% US Stocks

7.5% Foreign Stocks

35% US 10 Year Bonds

35% Corporate Bonds

5% GSCI

5% Gold

5% Real Estate

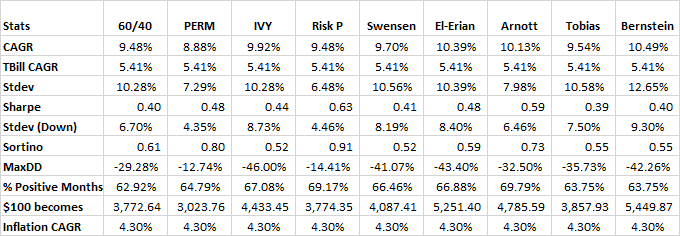

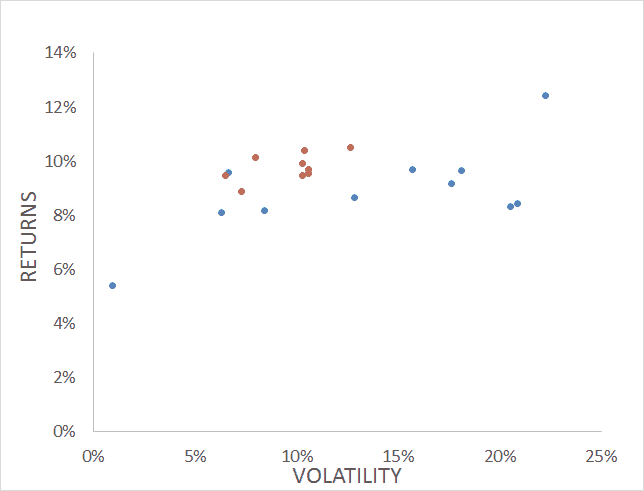

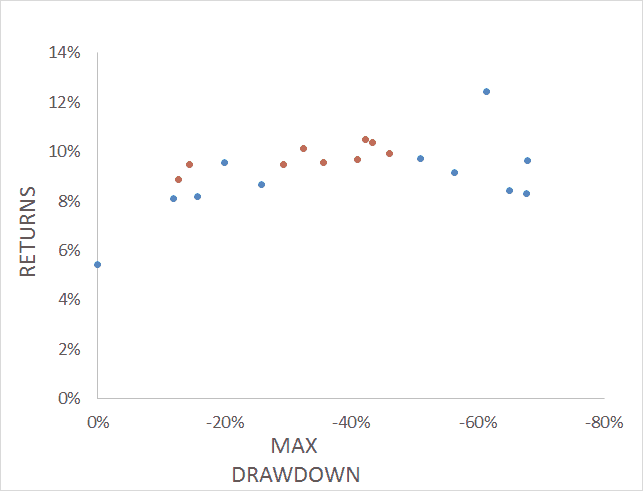

Below are three charts. The first is returns vs. volatility, the second is returns vs. maximum drawdown, and the third is returns vs. Sharpe Ratio. As you can see, they all performed pretty similarly. People spend countless hours refining their beta allocation, but for buy and hold, these allocations were all within 200 basis points of each other!

A rule of thumb we talked about in our book is that over the long term, Sharpe Ratios cluster around 0.2 for asset classes, and 0.4 – 0.6 for asset allocations. You need to be tactical or active to get above that.

Blue dots are generic asset classes, red dots are the portfolios from above.

What’s the takeaway? Go enjoy your summer.