Are coal stocks a buy? They are likely to finish 2015 down a whopping 5 years in a row, along with another hated sector, gold stocks. Both are down over 80% from their peak.

I’ve written a lot about reversion strategies on this blog and my books. It is always hard to try and decide when an investment has declined and is a true value, or when it has simply declined with more to go? There are lots of famous investing quotes to use here that may or may not be funny depending on your current holdings.

“Buy when there is blood in the streets”

“What do you call a market down 90%? It is a market that was down 80%, and then got cut in half from there.”

“Investing is the only business that when things go on sale, everyone runs out of the store”

“You want to be greedy when others are fearful. You want to be fearful when others are greedy.”

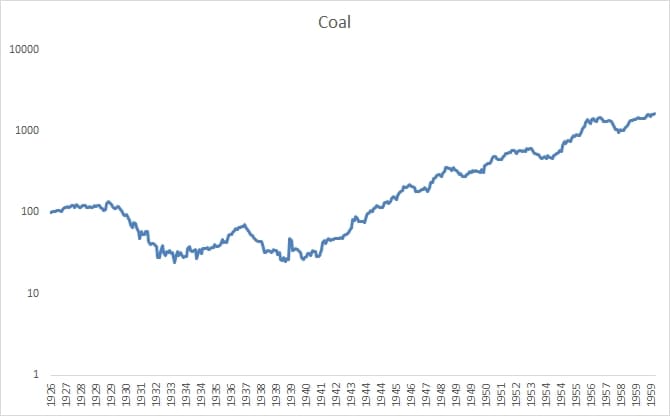

There is a FREE database of investment returns over on the French Fama website, so you can go play around with your own ideas. Such as – what happens if I were to invest in a sector after it had two down years in a row? Three? Four? etc. What about down 90%? It’s a fun exercise, and you can see just how rare down 4-6 years in a row actually is. Below is the data back to the 1920s. (Note these groups are often small groups of stocks. Thus, while their arithmetic returns will look higher the geometric will be lower due to volatility. So, the market didn’t really do 14%, but probably closer to 10% etc…)

So it often pays to be investing when others are fearful.

Ironically, the only industry to ever print 6 down years in a row?

Coal stocks. (ending 1933)

You can see the chart here and how it set the stage for great future returns…but it wasn’t until the early 1940s before they really started their bull run…