(Note: If you are an advisor that would like access to Cambria’s Trinity portfolios, shoot me an email to discuss.)

Are you a RIA thinking about partnering with a roboadvisor? Wondering how the various offerings and fees differ?

Or maybe you’re just a curious bystander, watching the evolution of robo shape our industry and wondering how it will shake out.

Either way, today you’re going to get a peek behind the curtain.

My company, Cambria Investments, just launched a separate account offering. But we did so only after vetting the majority of the players in the robo space. In a moment, I’ll share a bit of what we learned – the good and not so good. And I’ll tell you with whom we actually partnered and why. (Here is a nice Q&A overview of the offering with ETF.com)

But before we get there, let’s briefly check in on the current state of roboadvisors.

Where We’re At

I’ve been writing my thoughts and ideas on advisor technologies such as roboadvisors for a long time – ever since Wealthfront was kaChing! back in 2009, and since tax harvesting was one of my six fintech ideas. The landscape has changed quite a bit since then with new players and enhanced technologies. So in assessing where we are now, it helps to distinguish between the robo business model and robo technology.

As far as the business model, long before they even entered the market, I was saying that the custodians with their own funds would dominate due to the structural advantage of being able to use their own funds. And that has become the case. Vanguard’s hybrid cyborg model, which includes an advisor and charges 0.3%, has raised over $40 billion. Schwab’s 0% (kind of) fee offering has raised over $9 billion. While that sounds like a lot, realize this is still less than the AUM in asset allocation mutual funds that charge over 1.5% per year!

Despite the fact I expect the big sponsors to continue to dominate, that doesn’t mean there isn’t room for 5+ automated advisors. Maybe even 10. After all the #5 ETF sponsor manages $50 billion, #10 managed $25 billion, and #30 STILL manages $1 billion. Could there be 30 robos managing over $1 billion?

The ones without their own funds are at a disadvantage. So, of them, those that survive will be the ones that can achieve huge scale at their low fee structure, and/or operate with very low costs of customer acquisition and operating overhead.

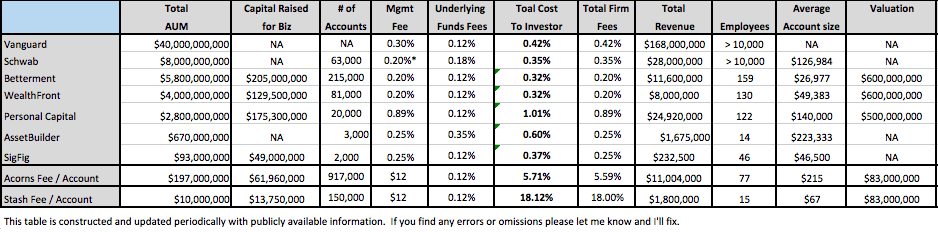

Here is a summary chart of the major robos and their assets and fees as of September.

Click to enlarge:

Now about the technology. Many advisors were initially fearful of this new, low fee offering. And while the managers that charge a lot for doing nothing should be afraid, most advisors that add genuine value in the traditional wealth management areas of estate planning, behavioral coaching, insurance, etc should see this as a major benefit.

Why? Well, as I demonstrate in my Global Asset Allocation book, most of these buy and hold asset allocation models have similar allocations. (And that’s not necessarily a bad thing. I wrote about the Wealthfront and Betterment asset allocations and performance here, and added in Schwab’s here. Note the similar returns). As a result, asset allocation is, for the most part, a commodity. But this just frees up the advisor’s time to focus on value added activities in the first place.

My broad thoughts on the robo technology space for advisors is that they should not fear the technology, but rather embrace it much the same way they have embraced rebal software…or even email. Like my friend Josh Brown said when email first came out: “Advisors didn’t start calling themselves ‘Email Advisors.’” Similarly, advisors that embrace robotechnology are not going to start calling themselves “RoboAdvisors” either. (I wrote about this last year in “The Robots Are Your Friend“.) Josh was one of the first advisors to embrace the new technology by adding Upside (now Envestnet), and others such as Wes Gray have actually just built their own (more later).

The advisors we’ll see flourish in the coming years will be those that adapt quickly to the new technology platforms, while excelling at their true value-add activities.

Our Recent Robo Experience

Let’s pivot now toward my own recent experience with robos.

While my company, Cambria, offers public ETFs, many investors still prefer the familiar feel of individual separate accounts, which is totally understandable. Therefore, like many investment advisors, we’ve long wanted to provide this separate account offering. The problem has been that the technology and user interface has been lagging.

We identified five main hurdles (beyond cost) in choosing a partner. Here’s what we were looking for in adding a robo-style technology solution for a RIA like ours:

- Online account sign up (absurd most custodians don’t have this already).

- Online account funding.

- Automatic rebalancing with no commission costs (and likewise, automatic tax lost harvesting in taxable accounts).

- Ability to design and customize the allocations.

- Trade execution is reasonable and thoughtful.

Surprisingly, these requirements eliminated many of the tech platforms we were considering. Below is a brief summary of what we learned about all the major players, as well as our thought process on how we arrived at our final partner.

- Wealthfront, Vanguard, Fidelity, etc – No current advisor solution.

- Envestnet– Would not disclose their fee structure without a NDA, which means I could not disclose it to the client which definitely goes against full transparency. Regardless, Investment News reports it is between 10 and 25 bps.

- Motif– Did not meet trade execution hurdles (was told they market in all orders).

- Folio, Hedgeable– Too expensive at 25+ bps.

- Schwab– Not fully customizable, though we expect this to change by the end of the year. Would like to add Schwab eventually.

- Marstone– Not out yet.

So, this leaves a few main contenders. We eliminated a handful more where the main concern was viability – either they had very few clients and thus revenue, or the offering was not as impressive as the below.

- TradingFront – This offering was started by, then spun out of, Alpha Architect. If we end up using Interactive Brokers as a custodian, TradingFront would be the choice. But IB is known for low costs and great tech, but poor customer service.

- Vanare – This is an impressive offering that partners with TD Ameritrade. If we end up using TD as a custodian, Vanare would be the choice.

- And finally, Betterment, our ultimate choice.

We went with Betterment for a whole host of reasons. They’re the #1 independent roboadvisor by assets under management. They have an amazing user interface for the advisor and the client. New accounts can be opened in 5 minutes, and likewise funded quickly. Allocations can be customized, and tax harvesting is available. The total fee is only 0.15% and the offering is commission free (which is huge for accounts under $300k.) Like many great websites and apps, you have this feeling that everything just “works”. Only a few downsides (like no international clients).

Finally, and most importantly, they are genuine and decent people across the board. The investing world is replete with scammers, charlatans, and worse, but everyone I’ve met at Betterment has been wonderful so far. I’ll update this every few quarters with new info on entrants and progress on all fronts.

So there you have it. A robo recap as well as our experience as a group that has just been through the process. If you run into me at any of my upcoming travels and want to chat more about our experiences here, grab me and say hello!

©2016 Cambria Investments, L.P. is a Registered Investment Adviser.

Information and recommendations contained in Cambria’s market commentaries and writings are of a general nature and are provided solely for the use of Cambria its clients and prospective clients. This content is not to be reproduced, copied or made available to others without the expressed written consent of Cambria. These materials reflect the opinion of Cambria on the date of production and are subject to change at any time without notice. Due to various factors, including changing market conditions or tax laws, the content may no longer be reflective of current opinions or positions. Past performance does not guarantee future results. Where data is presented that is prepared by third parties, such information will be cited, and these sources have been deemed to be reliable. However, Cambria does not warrant the accuracy of this information. The information provided herein is for information purposes only and does not constitute financial, investment, tax or legal advice. Investment advice can be provided only after the delivery of Cambria’s Brochure and Brochure Supplement (Form ADV Part 2A&B) and once a properly executed investment advisory agreement has been entered into by the client and Cambria. All investments are subject to risks. Investments in bonds and bond funds are subject to interest rate, credit and inflation risk.