Long time readers know that I have been a shareholder yield advocate on the blog for almost a decade. (We used to call it net payout yield back then, and we define it as the combination of dividends and net buyacks.)

People are slow to change of course, but my hopes are that eventually you all come around to a little common sense. Sometimes books and white papers are too much, and all that is needed is a simple chart or table that will change people’s minds.

Remember the old Dogs of the Dow strategy where you just invest in the 10 highest yielding Dow stocks each year? This strategy was popularized by O’Higgins, and historically beat the market. But as you all know, a shareholder yield approach does even better historically.

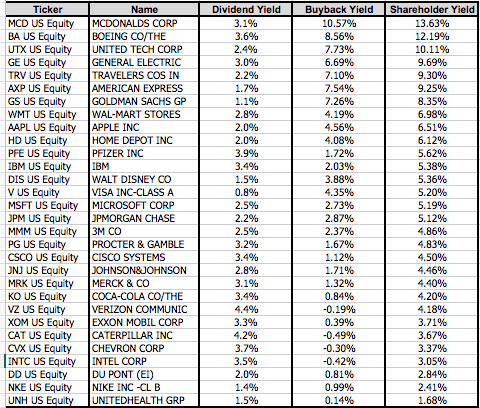

Below we list all 30 Dow stocks, their dividend yield, their net buyback yield, and their total shareholder yield.

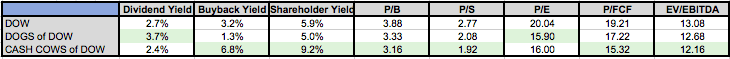

We then group the Dow stocks into the Dogs strategy and the shareholder yield strategy (what we call the Cash Cows.) Not surprisingly, the Dogs have the highest yield. However, they also have the lowest buyback yield. Overall the Dogs have a very similar shareholder yield to the entire Dow, but actually is slightly lower.

The Cash Cows, despite having the lowest dividend yield, have by far the largest buyback yield resulting in a total shareholder yield that is nearly double that of the Dogs and about a third higher than the Dow.

Click to enlarge

Here’s where it gets even more interesting. The Cash Cows strategy also has the cheapest valuations (median) across all variables except P/E ratio (and then it only nearly misses.

So a much higher total yield, and lower valuations. What’s not to like?