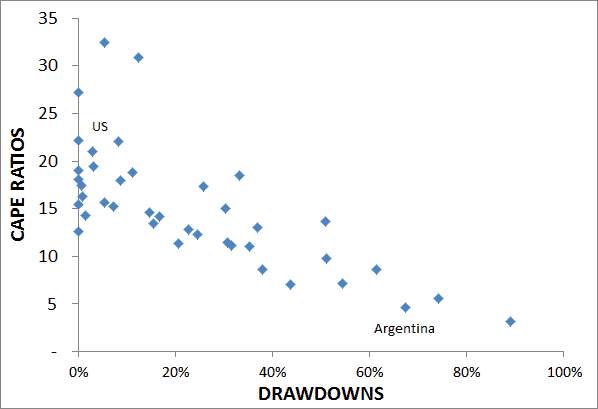

I’m pretty bullish on stocks right now. Global valuations are cheap, although the US is one of the top 4 most expensive markets on a 10 year CAPE basis. But right now, the US is allowed to be expensive.

Below are the two biggest threats to the equity markets. Let me explain:

1. Inflation mountaintop.

When inflation is tame countries are rewarded with higher PE ratios. This is true not just in the US but also abroad. When inflation is mild, say 1-4%, CAPE ratios are “allowed” to be higher, in the 20-22 range (the US is around 23 now). However, once you tip over 4% inflation is when you get into trouble.

The 4-6% inflation bucket takes CAPE ratios down to 17 (25% price decline), and 9%+ inflation takes you down to sub 15 (35%+ price decline) or even 10 (55%+). So while inflation is tame for now, realize it can get worse and we are priced at “the top of the mountaintop”.

2. Profit margins. We penned a longer piece on this in January, but I always get nervous anytime people (Siegel in this case) argue this time is different. If the gov withdraws and or profit margins contract you have a huge headwind for stocks.