This excerpt is from the book Global Asset Allocation now available on Amazon as an eBook. If you promise to write a review, go here and I’ll send you a free copy.

—-

“You can’t control the market, but you can control what you pay. You have to try to get yourself on automatic pilot so your emotions don’t kill you.” – Burton Malkiel, author of A Random Walk Down Wall Street

The most important principle for all investors is that they have a plan and process for investing in any environment, regardless of how improbable or unfathomable that may be. Are you prepared for all of the possible outcomes, such as declines of 50-100% in any one asset? Are you prepared for currency devaluations, but also massive rallies in stocks or bonds? Can you fathom a world with interest rates at 0.1%? What about at 10%?

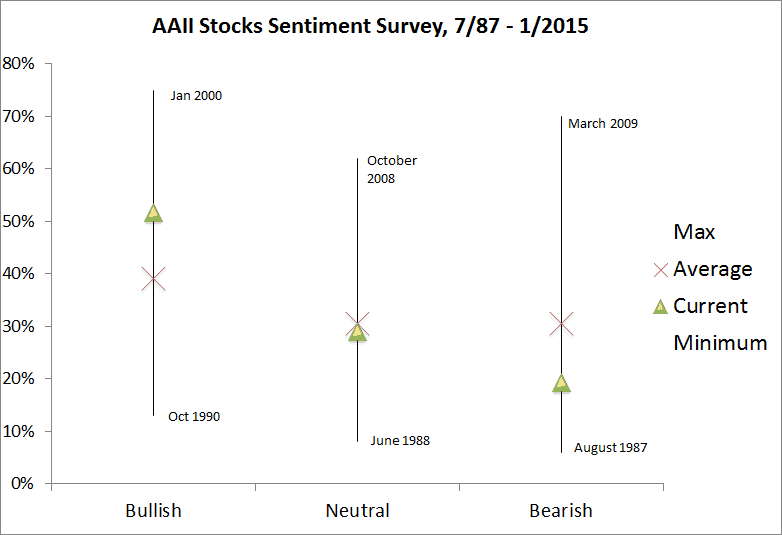

Modern portfolio theory holds that there is a tradeoff for investing in assets – you get paid to assume risk. One of the biggest things you can do for your portfolio is to remove your emotional decision-making. Look at the below chart and notice when people were most excited about stocks and most depressed. The exact wrong times! Study after study has shown how bad people are at timing their investments. (It’s not just individuals—it happens to professionals as well.)

FIGURE 43 – AAII Sentiment Survey

Source: AAII

Thus, first you need to get your emotions in check and have a plan. Then don’t do dumb stuff when it gets hard. Easier to say than do, but very necessary.

REBALANCING

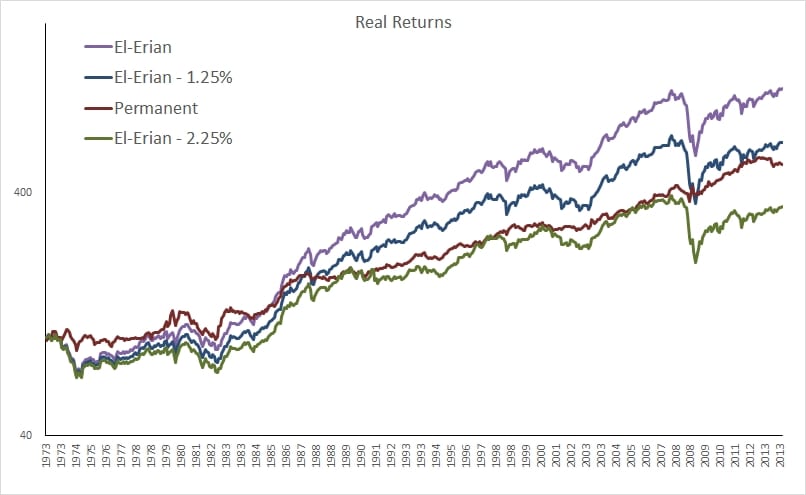

We said in our first book The Ivy Portfolio that rebalancing matters, as long as you do it sometime. The timeframe isn’t all that important, and doing a yearly, or even every few year rebalance is just fine. Yearly is just nice since it lets you review your investments, as well as make tax optimal changes. If the accounts are taxable, tax harvesting the losses on a consistent basis can add to your after tax returns. Below is the global market portfolio (GMP) from earlier in the book rebalanced monthly and never, and you can see rebalancing or not the returns are quite similar, and differ by less than 0.50% per year. But 0.50% per year is worth rebalancing for! The nice thing about using an allocation ETF, mutual fund, or automated investment service is that the investment manager does the tax harvesting and rebalancing for you.

FIGURE 44 – Rebalancing Portfolios

Source: Global Financial Data

FEES:

Next, let’s chat fees. Below are some ballpark fees for perspective:

- The average financial advisor charges 0.99 % per year. (Although the most expensive quarter of advisors charge over 2% per year.)

- The average ETF charges 0.57% per year.

- The average mutual fund charges 1.26% per year.

Source: PriceMetrix , Morgan Stanley, 2013

To let people know just how important fees are, below is an example.

What if you could predict the single best performing asset allocation ahead of time?

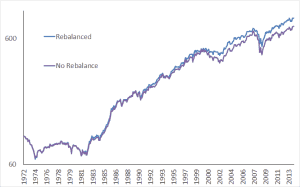

We took the best performing strategy, El-Erian, and compared it to the worst, the Permanent Portfolio. (Note we are just using real absolute returns and not risk adjusted where Permanent would rank much higher.)

What if someone was able to predict the best-performing strategy in 1973 and then decided to implement it via the average mutual fund? We also looked at the effect if someone decided to use a financial advisor who then invested client assets in the average mutual fund. Predicting the best asset allocation, but implementing it via the average mutual fund would push returns down to roughly even with the Permanent Portfolio. If you added advisory fees on top of that, it had the effect of transforming the BEST performing asset allocation into lower than the WORST. Think about that for a second. Fees are far more important than your asset allocation decision!

Now what do you spend most of your time thinking about? Probably the asset allocation decision and not fees! This is the main point we are trying to drive home in this book – if you are going to allocate to a buy and hold portfolio you want to be paying as little as possible in total fees and costs.

FIGURE 45 – Asset Class Real Returns, 1973-2013

Source: Global Financial Data

There are many great advisors and brokers out there that charge reasonable fees. And many advisors offer value-added services, such as financial and estate planning and insurance. Vanguard estimates the value of financial advisors can far outweigh the costs – mostly because they prevent you from doing even dumber things that you would do on your own.

However, if you are just looking for investment management services, you can simply buy a portfolio of ETFs, an asset allocation ETF or mutual fund, or enroll in any number of automated investment services (also called robo-advisors). There are a number of asset allocation ETFs that charge around and below 0.30% per year for a diversified global portfolio.

Below is a list of some automated services and their fees for a $100,000 portfolio. For comparison, here are a number of other famous investment advisors and their fees – you may be surprised you are paying your advisor up to and over 2% per year.

- Schwab Blue 0%

- Vanguard Personal Advisor Services 30%

- Betterment 15%

- WealthFront 25%

- Liftoff 40%

- AssetBuilder 45%

Recall that for a $1 million portfolio, a 2% fee is $20,000 per year. Instead of it being automatically deducted from your account, imagine literally carrying a briefcase full of cash to your advisor each year – that may change your perspective!

TAXES:

“One of the most serious problems in the mutual fund industry, which is full of serious problems, is that almost all mutual fund managers behave as if taxes don’t matter. But taxes matter. Taxes matter a lot.” – David Swensen

For a longer review on fees and taxes, take a look at “Rules of Prudence for Individual Investors” by Mark Kritzman of Windham Capital. It goes to show just how much alpha a mutual fund or hedge fund needs to generate just to overcome their high fees and tax burden (quick summary: it’s A LOT). Another good articles is John Bogle’s “The Arithmetic of “All-In” Investment Expenses”.

We’re not going to dwell on taxes too much, but we leave you with the simple advice to place all the assets you can in a tax-deferred account. Further, any taxable assets should be managed in the most tax-efficient way possible with tax-harvesting strategies. ETFs are often a superior tax vehicle over mutual funds or closed end funds due to their unique creation/redemption feature. The website ETF.com has a good education center for those looking for more information on ETFs.