Ever wonder if Ken Fisher beats the market?

If you’re searching for the answer online, you’re wasting your time. At least, I was; I couldn’t find his returns anywhere. But after some digging, I’ve tracked them down…and they’re very interesting.

I’m a big fan of Ken Fisher. For anyone who’s unaware, he’s a portfolio manager and the founder and CEO of Fisher Investments, a huge player in the money management space. If his firm isn’t the biggest registered investment advisor (RIA) it is close at $60B.

I’ve read nearly all of his dozen or so books (two of my favorites are Wall Street Waltz and The Only Three Questions That Count). He blends investment theory with a true appreciation of market history.

As someone who has been building a RIA from scratch, I’ve long been interested in Ken. He’s about as successful as you can be in this space so I was curious—what are we doing similar, and where do we differ?

We’re similar in terms of publishing investment research. Fisher is a prolific writer, in addition to the books he is the longest continuous contributor to Forbes. Similarly, I’ve just passed 1,500 articles, 10 white papers, and 5 books (phew!). Just cranking out tons of content isn’t useful if that content isn’t of value to the readers of course, but thoughtful analysis is a great route to spread your ideas and message. Some are naturally good at writing (it was a big struggle for this former engineer in the beginning), and Ken is one of the better ones. Josh Brown had a good speech on this at ETF.com recently on content creation and the takeaway was that it really doesn’t matter what your medium is (Twitter, blog, radio, YouTube, TV, etc) as long as you are creating insightful and valuable content somewhere. The Internet gives you a great platform for a soapbox, for better or worse.

But we’re quite different in the sales process. While we just hired our first marketing person this year, Fisher has a far greater focus on marketing. Unlike your traditional Wall Street wealth managers, Fisher’s business model relies on far more direct-to-mom ‘n pop advertising. I get about one mailing and phone call a month, but honestly, I find that more fascinating that annoying (the behavioral signals that light up people’s brains and get them to a call to action is a wonder to a biotech nerd like me).

This emphasis on sales leads to a lot of flak in the media—whether deserved or not. Either way, there’s no denying he’s a master of the direct mail and online lead generation process.

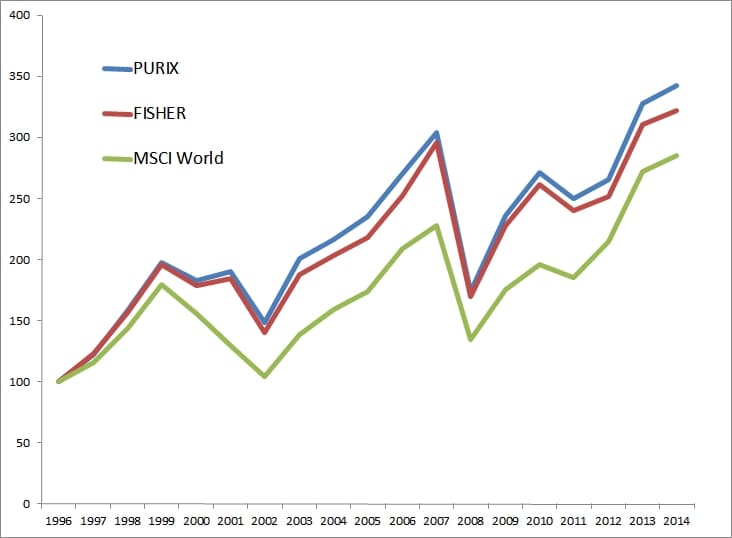

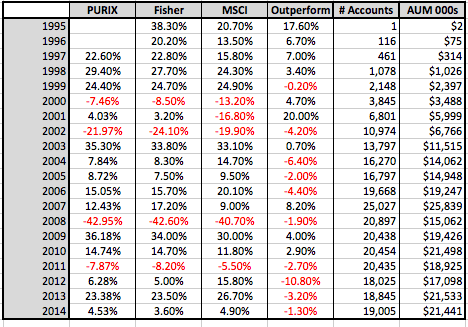

I was playing around on Fisher’s website and trying to find performance somewhere, anywhere as I know they are a GIPS compliant firm. RIAs don’t have to publish performance, but the GIPS are the gold standard for those that do. I eventually found the performance in the ADV (a filing disclosure), and also realized they have been running a mutual fund the entire time as well (Purisima, PURIX). So I compiled the main composite into a table below then compared it to their benchmark MSCI World and the mutual fund. The mutual fund and separate accounts have near identical performance, with an ever so slight edge to the fund.

A couple notes. Fisher outperforms over the period by about 1 percentage point a year after fees (outperformance bumps to nearly 2% if you include 1995 and 1996 as the separate accounts had two solid years before the fund started in 2006.). However, the performance is really a tale of two separate periods, 1995 – 2001, and 2002-2014.

In the first period, he outperformed by a whopping 9 percentage points a year. In part this is due to not getting hammered in 2001 by correctly buying puts on the market. But since 2002, he has underperformed by about 2 percentage points a year and like most, got pummeled in 2008. Oddly enough, Forbes and CXO found that Fisher has outperformed over time but that his performance may be fading.

This performance example also generates lots of classic questions for investors like “Why the shift in performance? Is Fisher less involved today than before? “, and “At what point do you separate from a manager that has been underperforming?” Here is an older article on David Einhorn of Greenlight that examines similar topics.

Possibly for this reason, his number of accounts for this composite and assets peaked in 2007. (Firm assets have continued to grow to over $60 billion.) 1.25% a year in fees is harder to swallow when underperforming vs. outperforming by 9 percentage points.

I was thinking about what I can take away from this as I try to grow my own RIA. I think it underscores the agony and ecstasy of being a money manager with a public track record. You can beat the market over the long term, but go through long periods of over/under performance. Much like this post on Buffett, how many investors can sit through seven, or fifteen years of underperformance? Not many.

All in all, I’ve enjoyed my interesting dive into one of the most fascinating money managers and historians of our time. I’ll keep reading whatever he writes!

PS Check out a fun interview with Ken and Barry here on Masters in Business.