-9%, 5%, -5%, -10%, 9%

Those were the daily returns of the stock market last week. Enough to give most market participants an ulcer.

The coronavirus is wrecking economies and overloading health care systems around the globe. Due to the uncertainty involved, one could easily make a case for two wildly different outcomes.

The Bull Case: Following the dire experience of Italy, countries around the world take the threat seriously. Tests are plentiful, events are cancelled, and citizens self-quarantine. Governments around the world coordinate fiscal, monetary, and health care policies to address most major threats. The infection rate peaks soon (we’re already seeing the number of new infections in China drop to single digits for the first time since reporting began back in mid-January), with hospitals well-staffed and able to manage the patient load. Deaths totals are mild. Treatments are developed, vaccines are distributed, and global immunity prevents any major future outbreaks.

Economies and markets rebound vigorously, citizens around the world are euphoric, and risk-on markets rebound with a fury not seen in decades. Financial markets hit new highs by year end.

The Bear Case: Some countries around the world take this threat seriously, but it is too late and the virus has already spread too far. Much of the global population ignores suggestions to self-quarantine. Cases go exponential, and hospitals are overwhelmed and unable to manage the patient load. Death totals soar beyond expectations. World leaders, celebrities, and athletes are not spared. Most people know a friend or family member that dies from the virus. Treatments are ineffective, vaccines are years away, and the experiments with herd immunity are a disaster. Governments try to implement various financial and social stimulus policies to no avail. Previously expected to be a short-term problem, economies and markets are impacted massively, citizens around the world are fearful and depressed, and risky financial markets continue to plummet.

The US stock market declines 30%, taking it back to its historically-average CAPE ratio valuation of around 18. Oil, real estate, gold, and most financial assets slide as well. The summer brings some relief from the virus, and economies improve and markets stabilize. People sense the nightmare is over. However, by fall the virus reemerges, prompting despair amongst global citizens and markets decline to valuation levels not seen since the bottom of the Global Financial crisis, another 30% down (to a CAPE ratio of 12), and 60% down from the peak in early 2020.

Which scenario is most likely to occur?

I don’t know. No one really knows, but the reality is likely somewhere in the middle.

But with such massively different future possibilities, many investors are wondering what to do…and the answer for most of us is…

Nothing. Or, as the late Bogle stated:

“My rule — and it’s good only about 99% of the time, so I have to be careful here — when these crises come along, the best rule you can possible follow is not “Don’t stand there, do something,” but “Don’t do something, stand there!”

We tried to drive this point home in our letter to shareholders last week titled “Time to Panic“? It’s worth a read, but here’s an excerpt:

“Global markets are experiencing large moves up and down today and many investors are freaking out.

US stocks declined enough at the market open, 7%, to trigger circuit breakers that paused trading.

Investors all over social media are panicking. Because they don’t have a plan.

But you do.

You put in the work over the past decade. You’ve read our blog posts and books, you’ve listened to the podcast, and eventually, you built a plan. And take note, they’re not all the same plan. But at least you have one so that when it hits the fan, like it is now, you’re prepared.”

Our investors have read our old pieces for the past 14 years that prepared them for this year. There was the piece on how really big daily stock market moves of 5 to 10% are pretty normal and tend to cluster together, particularly in down trends (“Where the Black Swans Hide“). We talked about the four quadrants of stock markets, and how when an expensive market flips from an uptrend to a downtrend things can get nasty (“Keeping it Simple“).

We also published a piece that demonstrated what assets helped to hedge these big down periods in stocks (“Worried About the Market?“). And it turns out, the assets that hedged historically (tail risk, bonds, cash, gold, trend) helped this time too.

You mentally prepared for the fallow periods, because you read the piece that demonstrated many assets can go long periods experiencing measly returns but still be worth investing in (“How Long Can You Handle Underperforming“). You learned to think in terms of decades rather than years by taking the long view after reading “The Get Rich Portfolio” and “The Stay Rich Portfolio“.

Let’s say you’ve read all of these pieces, you’ve listened to the podcast, and you’ve put your plan into place. Congrats! Now you get to sit back, relax, and do nothing. And that’s what I plan to do with my allocation. (Which, you’ve also read about in “The Trinity Portfolio” and in “How I Invest My Money“. Now, to be fair, it’s easy to “do nothing” when you own private assets where you couldn’t do anything even if you wanted to! Here’s a picture of me trying to figure out if farmland went up or down this past week…(actually from a few years ago)).

On the public side it’s easier said than done, and it’s harder to resist the temptation to check your brokerage balance every day. But this market, to me, illustrates the beauty of the Trinity Portfolios. Half the allocation is in a global buy and hold allocation across stocks, bonds, and real assets with tilts to value and momentum. So, if markets rip right back up, I’m covered. The portfolio will also rebalance and keep tilting more and more to the cheap stuff as it gets cheaper (and cheaper).

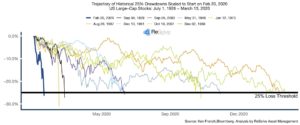

The other half of the allocation is in various trend strategies, and if markets continue their free-fall down, I’m also protected. Granted, some trend strategies didn’t help as much as normal this year, and many markets raced down. (Trend usually takes a little time to adjust from highs, and for US stocks we had the fastest move from all-time highs to bear market, ever.) Pic via ReSolve

So, I like to go halfsies in buy and hold and trend, or what I call buy and trend. Frankly, I never want to be “all in” in any outcome, because after all, the future is uncertain. Plus, it’s all automated so I don’t have to think about it.

So, I mainly plan to “just stand there”.

But the thing about big market dislocations is that they create massive stress. Emotional, financial, marital, and probably 10 other kinds. And these stresses lead people to act bananas-crazy with their money.

So, let that be your opportunity, and not your downfall.

Here are a few ideas to put in your quiver in the coming months. You don’t “need” to watch the markets for these, but during times of market dislocations there are some steps I think one can make that are reasonable and value add.

Let’s discuss a few.

Over-rebalancing

Over-rebalancing is a concept we talked about on both the Rob Arnott podcast as well as the Howard Marks one (he called it calibrating). Most people set a schedule to rebalance their portfolio. Say, if you held a 60/40 stocks/bonds portfolio it may rebalance once a year. However, given an extreme move down in stocks, you may consider taking the portfolio to, say, 65/35. (Note: I didn’t say 90/10. You should also identify what “extreme” means to you ahead of time and try to codify it.)

Again, think in terms of “over-rebalancing, trimming, and calibrating” and not a “bet the house all-in or all-out”. That’s a prescription for the poorhouse.

Try not to burden yourself with the requirement of perfect timing for adding to your portfolio during this selloff. For example, let’s say you were a prudent investor, amassed a stockpile of dry-powder cash ready for crisis investing, now you have it and…when to put it to work? Of course, that’s not an easy question to answer (though it is in hindsight!). After all, if the markets rebound quickly, the answer is “now.” But if the coronavirus is destined to hit us with a second wave in the fall, and markets drop another 30%, then an investment today would be premature and quite painful.

Again, no one has a crystal ball, so no one can time the markets perfectly – so stop making that demand of yourself. Perhaps the better approach is simply considering at what levels of pullback you’d feel its appropriate to deploy your cash. Note I didn’t write “feel comfortable” but “appropriate.” After all, it will probably feel scary putting money into the market at any time in the near-future given this volatility.

But “now” might be worthy of one tranche of your capital… down another 10% might warrant a second tranche… and so on. The answer is specific to you, the amount of capital you have to invest, and your belief about how our world and the markets will respond to this situation. For others, they’ll just continue to dollar cost average each month in their 401k (mine goes into emerging markets each month).

Regardless, the appropriate question to ask yourself isn’t “is this the bottom?” but rather, “in five or ten years, is there a good chance I’ll be happy I invested at this level?”

Opportunistic Investing: Buying a $1 for $0.50

In times of market panic many assets can trade away from fair value. I mentioned on twitter that placing limit orders below the bid on names you would like to own can be a tool to pickup some shares at nice discounts. Just make sure you want to own them, as you may just get filled!

Another similar concept is investing in funds that really trade away from NAV, and I’m talking closed end funds. Most of the time these funds trade within a few percent of NAV, but at times of stress they can get to 20%, 40%, or even greater discounts. Note: many of these funds use leverage and have higher expense ratios so do your due diligence…I’m planning on adding to one in the coming weeks that is currently trading at a 40% discount as well as buying back its own shares.

Blood in the Streets

Buying totally hated, blood in the streets, bombed out assets can be a great idea. We did an old post detailing that closing your eyes, holding your nose, and buying sectors and industries down a lot and holding for a few years can be a great strategy. Right now that’s markets like the oil and gas exploration industry, currently down 90%! One could scale into these markets over time, or perhaps wait for a signal when the market moves above the long term trend. Both seem reasonable to me.

Summary

I hope this helps. And as always, we’re here for our investors if you want to talk. But likely you don’t need to, because you prepared for this.

Stay safe and healthy everyone!