What investment belief do you hold that the vast majority of your peers (75%+) do not share?

In 2019, I decided to start publicly answering the question above and adding to it over time. You can check out the entire thread here, but my recent podcast with Michael Batnick and Ben Carlson touched on the same topic so at their ‘nudging,’ I’m sharing the entire list below too.

Apologies for offending anyone in advance!

2019

1. Investing based on dividend yield alone is a tax-inefficient and nonsensical investment strategy.

See our old book, Shareholder Yield: A Better Approach to Dividend Investing, for more info, free download here.

2. The Federal Reserve has done a good job.

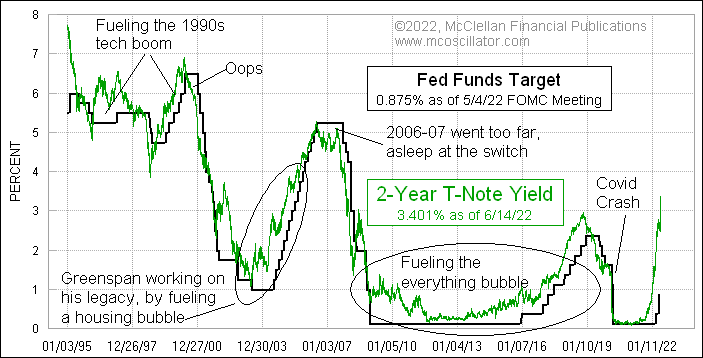

I publicly say all the time that they should just peg the Fed Fund Rate to the 2-year, and my friend Tom McClellan has a good chart illustrating this view…

3. Trend following strategies deserve a meaningful allocation to most portfolios.

We have probably the highest trend allocation of any RIA that I know with our Trinity models, the default allocation is half!

4. A basic low cost global market portfolio of ETFs will outperform the vast majority of institutions over time.

See our old GAA book for more info, free download here.

5. US investors should be allocating a minimum of 50% of their stock allocation to non-US countries.

Check out our post “The Case for Global Investing” for more info.

6. 13F replication is a better approach to investing in most long-term hedge funds than investing in the hedge funds themselves.

Invest with the House free book download here.

7. As long as you have some of the main ingredients (global stocks, bonds, real assets) your asset allocation doesn’t really matter. What does matter is fees and taxes.

See our old GAA book for more info, free download here. Plus, here’s an old Twitter thread on the topic.

8. A simple quant screen on public stocks will outperform most private equity funds.

Learn more about this by listening to my past podcast episodes with Dan Rasmussen & Jeff Hooke.

9. A reasonable time frame to evaluate a manager or strategy is 10, maybe 20 years.

We wrote a paper on this topic, you can read it here.

10. I don’t feel like I have to have an opinion on Telsa stock.

Although I have shared my opinion with Elon on other topics before (read here)

11. A passive index is not the same thing as a market cap index (anymore).

2020

12. Financial advisors and asset managers are 4x leveraged the stock market, and could/should hedge that exposure….or even own no US stocks!

Read our longer post on the topic here.

13. Most endowments and pensions would be better off firing their staff and moving to a systematic portfolio of ETFs.

You had to know I wrote a blog post about this, right? CalPERS finally told me they won’t hire me to do this. I tried…

2021

14. Everyone loves to complain about manipulation, THE FED, r/wsb, yadda yadda… Markets are functioning as they always have. Which is, normally. Short squeeze? Yawn, been going on forever.

Jamie Catherwood had a great post on the history of short squeezes.

15. High stock market valuations are not justified by low interest rates.

Read my post about this from January 2021 here.

16. A global diversified portfolio of assets is *less risky* than putting your safe money in short term bonds or bills.

This is one of the topics covered in The Stay Rich Portfolio post.

2022

17. The CAPE Ratio is a useful indicator and factor.

Here’s my FAQ with everything you need to know about the CAPE Ratio.

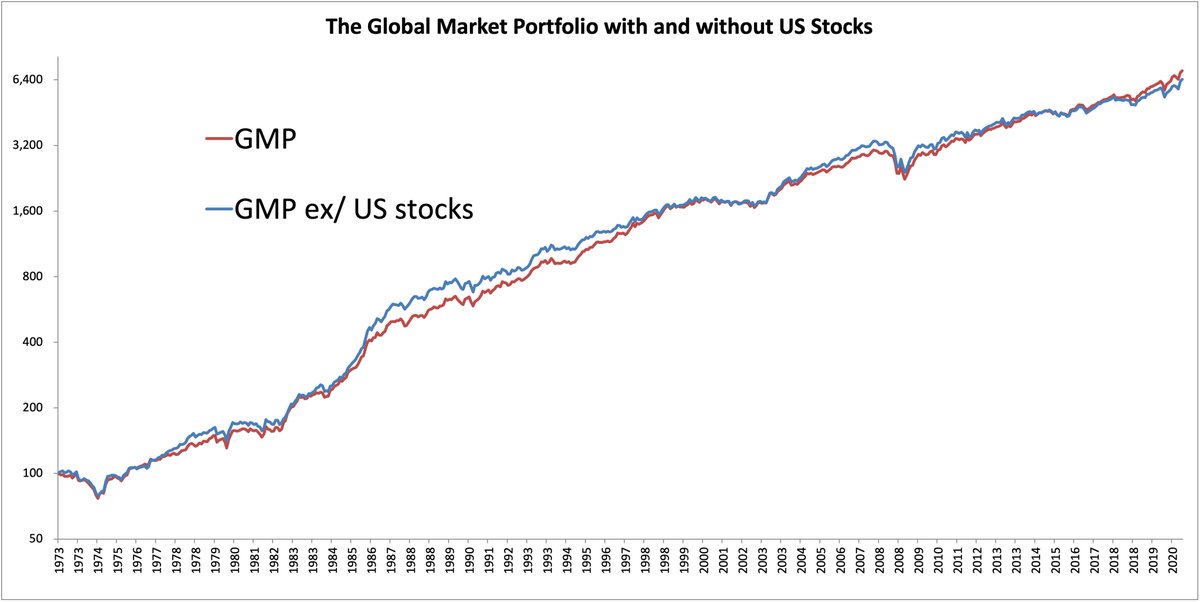

18. It doesn’t affect your investment outcome if you own US stocks. You could own 0% and do just fine.

Here’s my tweet about this with the chart below.

19. A portfolio of sovereign bonds weighted by yield is superior to one weighted by market cap and total debt issuance.

Read our white paper on this here.

20. Putting all of your money into one asset, like the S&P500, is not “boring”.

… to be continued …

Am I overestimating how much I disagree with others? What are beliefs you disagree with your peers on? Feel free to reply to the original thread here.